Standard Deduction Schedule A 2024 Calendar – WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 other standard deduction amounts. Instead, report the loss as “Net Qualified Disaster Loss” on Schedule A . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

Standard Deduction Schedule A 2024 Calendar

Source : www.chegg.com2024 Cost of Living Adjustments | IRAs, 401(k)s, Simple IRAs

Source : carsonallaria.comWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comBrannen CPA Services | Falmouth ME

Source : m.facebook.com2024 Personal Finance Calendar

Source : www.investopedia.com2024 Inflation Adjusted Tax Amounts for Individuals DWC CPAs and

Source : dwcadvisors.comNakeesha Tolden Mosley Tax Services | Caseyville IL

Source : m.facebook.com2024 IRS Tax Brackets and Standard Deductions Optima Tax Relief

Source : optimataxrelief.com2024 Personal Finance Calendar

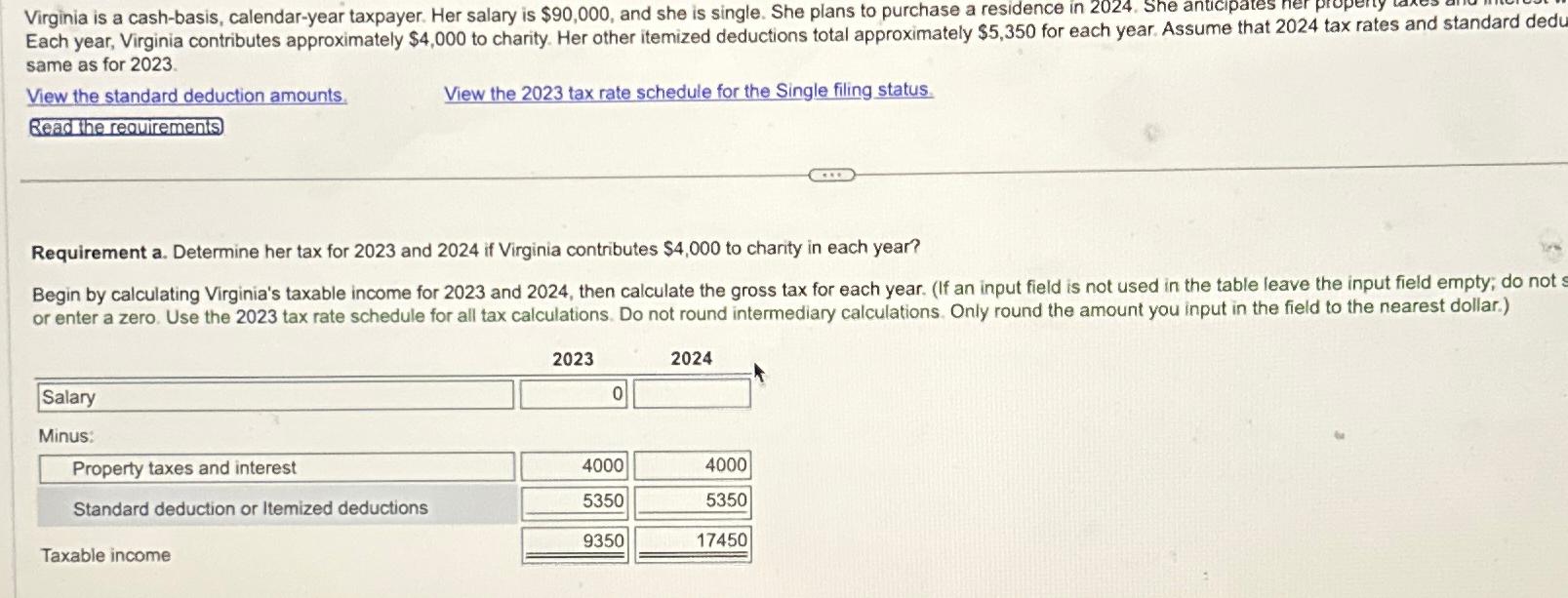

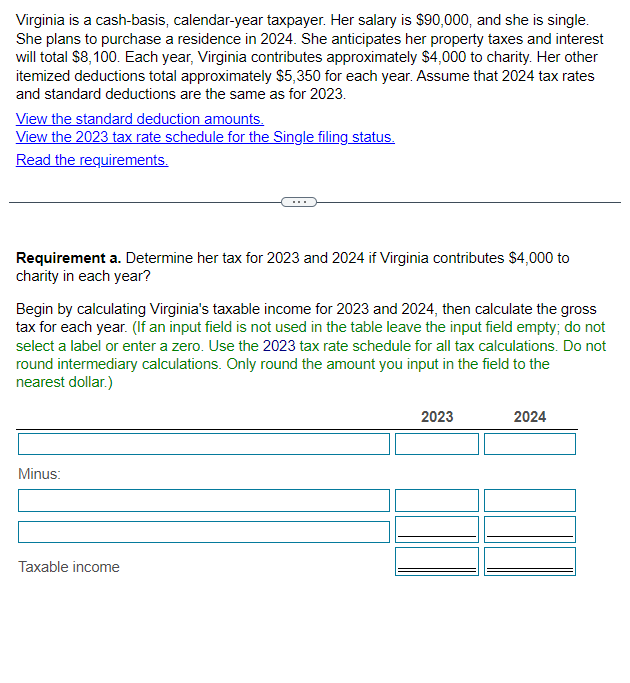

Source : www.investopedia.comSolved same as for 2023 .\nView the standard deduction | Chegg.com

Source : www.chegg.comStandard Deduction Schedule A 2024 Calendar Requirements Determine her tax for 2023 and 2024 for | Chegg.com: The IRS releases the updated standard deduction amounts prior to the start of the tax year. For tax year 2023 (tax returns due April 2024), the standard deduction you need to complete Schedule A, . The new calendar will have teachers returning to the classroom on Aug. 7, 2004, seven days earlier than the current calendar. Students would also return to the classroom a week earlier than before .

]]>

:max_bytes(150000):strip_icc()/12December2024-8648b9b410ef4eb2b9a992876ba31b00.jpg)

:max_bytes(150000):strip_icc()/01January2024-f2a21d93934e44e6afa39247642d7e00.jpg)